When clients don’t understand the importance of insurance, I share this story with them.

Before the Titanic’s first voyage in 1912, it was marketed as unsinkable. No one seemed concerned, then, that the Titanic set sail without enough lifeboats for all aboard. After all, lifeboats wouldn’t ever be needed.

Yet in the foggy early morning hours of the Titanic’s maiden voyage, it hit an iceberg. When the alarm sounded and the more than 2,200 passengers and crew rushed to the decks to find lifeboats — the most important thing to save their lives — there weren’t enough for everyone. Because of that, 1,500 people died.

In my 40 years of selling risk protection products, almost everyone I approached thought they were unsinkable. Then I told them the Titanic story and explained I sold lifeboats — and that every life insurance, disability and critical illness policy is a lifeboat. The discussion changed immediately.

I would ask them, “How big do you want your lifeboat to be? Is it only for you, or do you want to include your family?”

Then my life changed on February 14, 2020. Our Titanic hit an iceberg called cancer. My wife, Joyce, of 53 years, was diagnosed with stage 4 ovarian cancer.

I had a large financial planning practice in Johannesburg, South Africa, built on the MDRT principles of honesty, trust and service. My wife, however, needed me more than my business did.

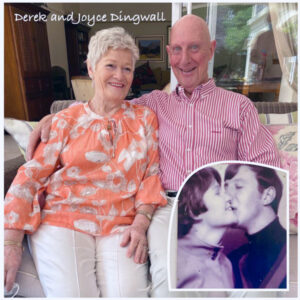

Joyce and Derek Dingwall, recently and from when they dated as teenagers.

Fortunately, I had a large critical illness policy on my wife that paid out 100% tax free. This was to be the lifeboat that would allow me to hand over the entire practice, including five support staff, to another financial planning group that was willing and able to take over. I felt the same financial relief I had promised my clients for all these years.

The good news is my ship is still sailing. Joyce survived the cancer and gets better each day. We are now enjoying our retirement together.

Everyone needs a lifeboat.

Derek Dingwall, of Benoni, South Africa, is a 42-year MDRT member.

For more ideas about how to talk to clients about insurance:

- Watch “Telling is not selling”

- Read “Dignity planning”

- Read “The crucial need for critical illness insurance”

Similar Posts

Give clients a reason to like you

Are you losing potential clients when they ask what you do for a living?

MDRT ideas for connecting better with clients